Shopper abandonment rate–or the number of people who visit your site, but don’t successfully check out–can put a significant dent in sales for the average online retailer. According to the Checkout Conversion Index (CCI), the estimated cost of that breakup with consumers is about a 42 percent loss of sales. One of the best ways online retailers can decrease their abandonment rate is to provide Ecommerce payment solutions that are mobile friendly (and mobile friendliness is an absolute must-have). To save you some time on research, we’ve compiled a list of the most affordable Ecommerce payment solutions for retailers.

A Few Payment Terms to Know

- Merchant Account- A bank account that enables the holder to accept credit cards for payment. All online retailers must have a merchant account unless using a PSP.

- Payment Gateway- Ecommerce application service provider linked to the merchant account that authorizes credit card or direct payments processing; keeps customer payment info secure.

- Payment Service Provider (PSP) - If you don’t want to setup a merchant account, the PSP is a third-party that offers shops online services for accepting electronic payments (via credit card, bank, etc.).

- Chargeback - a chargeback occurs when the cardholder disputes the merchant’s sale for any reason (e.g. customer never received the product or transaction was fraudulent).

Factors for Choosing an Ecommerce Payment Solution

- Setup Time & Cost - using a PSP is a ready-to-go solution, but may have higher fees associated with each transaction; alternatively, setting up a merchant account with a payment gateway takes more time, but may be less expensive in the long-run.

- PCI Compliance - every business accepting online payments must adhere to a strict set of security standards for processing payments securely. Make sure the solution you chose is PCI compliant. Third-party apps will cover you on compliance.

- Integration - if you’ve already set up an Ecommerce platform, you’ll want to find out how the payment solution integrates.

- Transaction Processing Time - every solution will have a different waiting period in between when the customer pays and when you receive the money. Understanding this process is crucial to avoiding an unexpected delay.

- Customer Experience - if you set up a payment gateway and merchant account, customers will stay on your site to make purchases. Contrarily, a PSP may redirect the buyer to the its site, potentially resulting in abandoned sales.

Questions to Ask When Considering a Payment Solution for Retail

When considering which Ecommerce payment solution is right for your business, ask yourself these questions first:

- Will I be processing transactions within the US, internationally or both?

- How many transactions will I have monthly, on average?

- How much time do I have to set up the solution (activating plugins, setting up APIs or buying a ready-to-go solution)?

- What method of payment do most of my customers prefer?

- How important is the customization and branding of the solution I choose (i.e. redirect to their page vs. keeping them on your page with your logo)?

- How much on-going support do I want?

Comparison of Most Affordable Ecommerce Payment Solutions

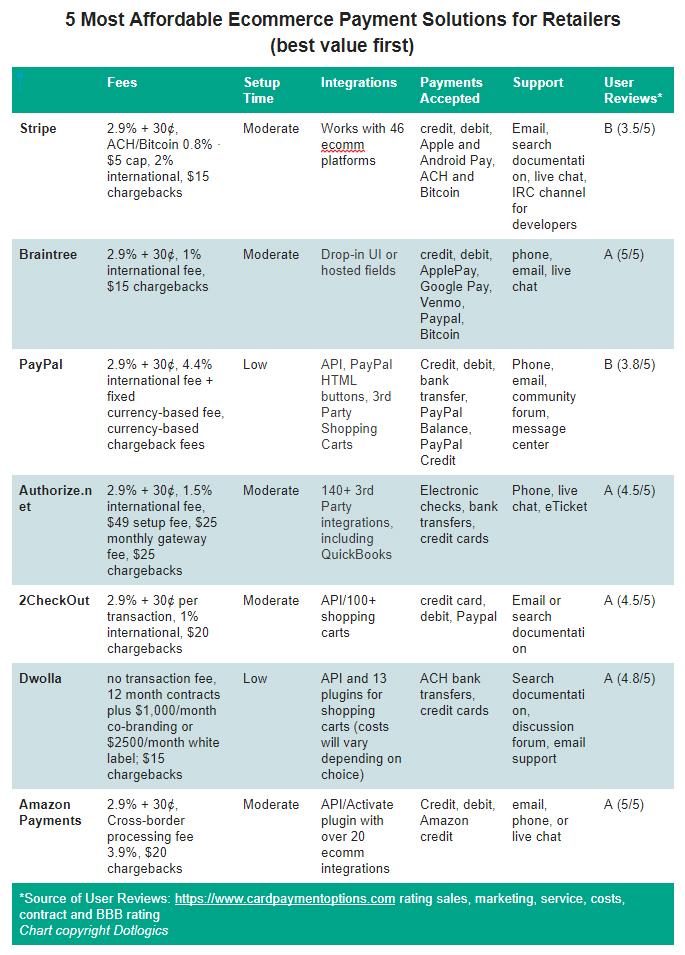

The following chart considers several factors for determining which solutions offer the most value at the lowest cost. This list is geared toward small business retailers who do business both domestically and internationally (or will scale to do so), and have limited resources and time for setup. Because smaller retailers are competing with big dogs like Amazon and BigCommerce, it’s also important to accept as many payments options as possible to win over your shopper. As such, here are our top 5 picks for the most affordable Ecommerce payment solutions:

Pros and Cons of Each Payment Solution

Stripe

This payment solution eliminates the need for a merchant account and gateway. Squarespace uses it, and it’s powered in over 25 countries. Ironically, Paypal was one of its biggest investors.

ProsOne great feature is that you don’t have to set up a merchant account, saving some setup time. This solution accepts not only cards, but ACH and Bitcoin payments, giving your buyers more flexible payment options. Transaction fees are similar to other services, but the $0 chargeback is an appreciated differentiator. There are loads of integration options so if you already have an Ecommerce platform, this will easier to add-on.

ConsYou may have to wait a week after each transaction to access money. Although you can accept payments from all over the world, merchant accounts are only available to the US, Canada, UK, Australia, and many European countries. You may need to hire a programmer to design the interface, and this will cost you more money. While it still has a high user rating, the number one complaint is the costs and contract, so check that in detail if you go with this solution.

Braintree

Founded in 1997, Paypal acquired this startup in 2013 for 800 M in cash. Quoted as the “next generation Ecommerce startup,” Braintree offers a sandbox to try them out and is a good start for businesses with regular services and prices. Currently, Paypal Commerce (Braintree product) is in beta testing, a feature that will allow retailers to “monetize [their] platform while instantly onboarding new retailers.”

ProsOffers a free sandbox to test it out before committing. The solution accepts the most payment options of the five listed (including Venmo), both online and mobile, in 130+ currencies. They also offer a discounted rate of 2.2% + $.30 for eligible nonprofits and volume price discounting. Transaction processing time (time it will take to get your money) also seems to be one of the quickest at an average of 2

business days.

ConsThe integration choices are Drop-in UI or hosted fields. You’ll need to choose one of these methods to collect customer payment information. There are several steps in either process, so you may need to hire someone to do this for you, especially if you don’t have the technical know-how to do it yourself. User ratings on the chart are A+, but keep in mind that is from only 14 reviews.

PayPal

Now the parent company of Braintree, PayPal is perhaps the most well known and most popular online payment solution. It began its life as a money transfer service in 1999 before being acquired by eBay in 2002. As it grew in popularity, PayPal spun off from eBay in 2014. As of 2017, PayPal operates in 202 markets and has 218 million active accounts.

ProsPayPal is incredibly easy to set up and use, and its popularity around the world will likewise make it easy for users with their own PayPal accounts to make purchases through you. You can also integrate PayPal with a large number of shopping cart systems, and use it to set up recurring payments

ConsPayPal’s chargebacks policies vary based on currency, but can be rather expensive. Businesses are limited in terms of use and can be subject to PayPal account suspension at any time, which can in turn cause funds to be frozen for months.

Authorize.net

Authorize.net is a US-based payment gateway founded in 1996. It is now a part of Visa Inc, which purchased the company in 2010. Authorize.net has been kept separate from Visa’s other gateway and former parent, Cybersource, which focuses on larger, international companies.

ProsAuthorize.net offers a free mobile point-of-sale app, as well as free fraud prevention tools and a website payments seal for its customers. The company has a large selection of third party partners that can be integrated into your site, and also offers recurring billing services and a customer information manager.

ConsThe company also works with a very large network of third party merchants who can act as resellers for its services. While this can sometimes lead to discounted rates for customers, it can also cause confusion about the cost of services, and frustration over unclear pricing structures.

2CheckOut

Alan Homewood started 2Checkout out of his home in 1999. The company has been serving businesses for over 15 years and is trusted by over 50,000 merchants, in over 200 markets, making it one of the best options for retailers who do business internationally.

ProsThe pre-integrated payments gateway and integration with more than 100 shopping carts is a tremendous time saver. The PCI compliance and fraud prevention are top notch. Additionally, this is one of the most cost-effective choices since there is no setup fees, no monthly fees, and no service length requirement. Another unique feature is the ability to collect upfront deposits.

ConsThere’s a hefty $20 fee per chargeback, and the average fee for currency conversion is 2-5% above the daily bank exchange rate. However, you will find these the same charges with most international transactions across the board.

Dwolla

Dwolla launched in 2010, powering billions of dollars in commerce annually. Its biggest draw is for businesses whose customers frequently use ACH bank transfers, and not just credit cards,

to make purchases.

ProsFrom next day transfers for no extra cost, no transaction fees, and minimal transfer delays, the whole bank transfer experience is much easier with Dwolla. Users review that the integration and post-integration support are efficient for getting setup quickly, plus you can customize the user interface for more branding options.

ConsWhile there are no transactions fees, there is an annual commitment and monthly charges $1,000 for “co-branding” or $2500 for “white label”. Co-branding requires your users to set up their own customer-facing Dwolla accounts as part of the payment process, and it would show Dwolla’s logo rather than your own. If you do a lot of transactions and think it will outweigh the monthly cost, this may still be the better option for your store.

Amazon Payments

Amazon Payments joined the industry to compete with PayPal and Google Checkout. It’s no secret that Amazon is the leading e-retailer in the United States with more than 135.99 billion U.S. dollars in 2016. This payment solution is a smart choice for businesses whose customers are consistent Amazon users.

Pros

The greatest benefit of this solution is that buyers don’t have to put in information to make purchases and it’s well trusted, potentially decreasing shopper abandonment. Customers simply use their existing Amazon account to skip the checkout process.

ConsAlong with the standard transaction fees, a Cross-border processing fee of 3.9% applies, and chargebacks are $20. If you do a lot of international transactions or returns, these charges can add up quickly. Additionally, there are several steps in the setup process that appear to be quite laborious, so again, you may need to hire someone to help implement. And don’t forget that if your customers don’t use Amazon, they will have to go through steps to set up an account.

Remember that finding the most affordable Ecommerce payment solution for retailers depends heavily on who your customers are and how they check out. Looking at transaction fees is the tip of the iceberg; other factors such as security compliance, and especially integration and setup time are equally as important as cost. Ultimately, customers want a no-hassle and quick checkout process with prime customer support; that is what will reduce shopper abandonment and bring your business

more revenue.

-

Ready to implement a payment solution on your website? Contact Dotlogics to get started.

Let's Get to Work.

Have an unsolvable problem or audacious idea?